To be (Customer Focused) or not to be? is by Ray Miller

This is the first in a series of short articles about understanding why customer focus is strategically important, what it means to be truly customer-focused and how to create or improve customer focus in your organization. This article presents a simple business case for the strategic importance of creating greater customer focus. Many excerpts are taken from the book, That’s Customer Focus! We hope you find in interesting and helpful.

Most of you will probably recognize this soliloquy from Shakespeare’s Hamlet

To be, or not to be: that is the question:

Whether ’tis nobler in the mind to suffer the slings and arrows of outrageous fortune,

Or to take arms against a sea of troubles,

And by opposing end them?

To die: to sleep;

No more; and by a sleep to say we end

The heart-ache and the thousand natural shocks That flesh is heir to, ’tis a consummation

Devoutly to be wish’d.

To die, to sleep;

To sleep: perchance to dream: ay, there’s the rub;

A popular interpretation of the speech suggests that it is a debate on suicide. Hamlet considers the attractions of death (“not to be”), which he refers “to a sleep”, over life (“to be”), where pain seems unavoidable. But in the end he decides that his fear of possible suffering in the afterlife as opposed to the known evil that is life stops him from actively ending his existence.

What has this got to do with Customer Focus?

Based on the unacceptably high levels of poor or mediocre customer service, prevalent across North America and other parts of the globe, it appears that many companies seem to favour “not to be”. The evidence we have to support this view surrounds us. Everyone of you, that has taken the time to read this article, for which we thank you, has undoubtedly experienced poor or mediocre service personally if not today, than very recently.

If you will allow me a little poetic license, with the first few lines of Hamlet’s immortal speech;

To be Customer-Focused, or not to be Customer Focused that is the question:

Whether it ‘tis better to do what is necessary to reap the benefits of being truly customer-focused

Or maintain the status quo and do nothing but continue to handle customer complaints, put up with customer churn and operational inefficiencies

And by doing nothing?

Commit long-term corporate suicide…

Customer Focus Is Not an Option

Everywhere you turn, Corporate head Offices extol the virtues of service but when it come down to it, most of the time they are really paying accelerated lip service to this the importance of service.

This is very curious, particularly when you consider the number-one reason why that small number of service leaders, you know, those few companies where the service is almost always really great, consider customer service a.k.a. customer focus to be a critical business strategy.

What is the Number 1 reason you ask?

Customer Focus is a Profit Strategy!

This happens in a couple of ways. Truly customer-focused companies have loyal customers.

Loyal Customers:

– buy more,

– cost less to serve because they know your processes,

– tell you when things go wrong so you can fix the problems and

– tell their friends, family and associates about how great you are and as a result you get more customers.

Also, customer-focused companies are more productive. Employees are motivated, and perform their jobs more effectively.

Re-work, duplication of effort and mistakes are significantly reduced. These all cost you money in terms of time spent, money spent, loss of productivity and loss of business.

Your turnover also reduces so you keep your staff longer and don’t experience down-time, productivity losses and employee morale related issues.

If you are still not convinced, consider the following:

It’s 5 times more expensive to attract a new customer than to keep an existing one.

It is safe to say that it is far more profitable and far less costly to keep the customers you have by building their loyalty, than it is to keep replacing them with new customers.

Determining what it costs to acquire customers is a bit intangible for most people. As you can imagine, at lot goes into getting customers to walk into your place of business or call you. Advertising, merchandising, promotions, premises expense, phone systems, salaries and so on are costs associated in part with getting customers.

Someone has to pay for this. Normally payment comes through the proceeds of revenue you get from the sales of your products and services. Sometimes we tend to take this for granted. Research has proven that once you have a customer, your cost of keeping him/her drops dramatically over time. When you lose a customer you will inevitably incur a higher cost to replace the one you lost.

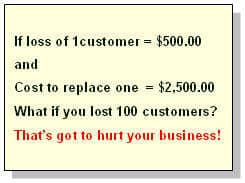

Assuming your cost to acquire a customer is $250 and based on the fact that it is 5 times more expensive to acquire a new one, your new customer acquisition cost would be $1,250 for each new customer required to replace one that defected. Based on the example above, assuming you lost 20% of your customer base, the annual cost to replace these customers would be $62,500.

Over five years this cost would be $312,500 and you would have turned over all your customers in that period. Can you think of any better uses for the $312,500?

About 75% will do business again if the problem is resolved to their satisfaction.

90 to 95% will do business again if the problem is resolved on the spot.

Since mistakes are guaranteed to happen, how you recover from these mistakes will significantly impact on whether the customer will do business with you again. It is important to note that research suggests that if you recover well, your customers will stay with you.

The faster you recover, if you can resolve the issue “on the spot”, your customers will be impressed and in all likely-hood reward you with their continued business.

Customers are willing to pay for quality service.

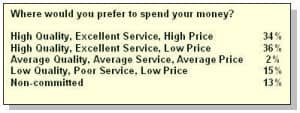

In a series of polls we conducted last year with about 1000 course participants, we asked where would you prefer to spend your money? The results compare very favorably with research we have reviewed that suggests that the vast majority -70%, of customers are willing to pay for high quality service. Obviously price is a variable, but service is a constant.

An increase in customer loyalty will have a direct positive impact on your bottom line.

Harvard Business Review conducted research which reveals that a 5% increase in customer loyalty can result in a return of 25% to 125% directly to the bottom line depending on your industry. It is safe to assume that investing time and resources to retain even a small number of your clients would pay for itself. You can do the math. Be conservative and take your gross profit and increase it by 25%.

The cost of poor service has a direct, negative impact on your bottom line.

Consider the time and expense associated with fixing problems, dealing with customer concerns, replacing product, re-working reports, and so on. Research from TARP (Technical Assistance Research Programs) indicates that, based on your industry, the cost can be significant.

Pick one of these two and do the calculation.

Wouldn’t you like to have this as profit, rather than as an expense?

The financial gains associated with creating a customer-focused organization can be substantial and well worth the effort.

To quote our friend Hamlet once again

To sleep: perchance to dream: ay, there’s the rub;

In today’s highly competitive market place we really cannot afford to take the easy way out. Creating customer focus takes commitment, at all levels of your organization, a comprehensive strategy which targets leveraged actions which will positively impact customer perception, and the will, fortitude and financial support to make the changes necessary to be truly Customer-Focused.

Ray Miller is Managing Partner of The Training Bank, a Training and Consulting firm specializing in Customer Focus, Service Improvement, Leadership and fully

customized training solutions. He is also co-author of the book That’s Customer Focus Please explore our web site and discover how you can be more customer focused.